The Open Enrollment Period (OEP) is the authorized annual time to sign up for a new health plan in the Marketplace when you can update and evaluate your previous plan. This time span of ACA plan registration generally starts from November and ends in January.

There are other conditional rules and exceptions in OEP based on situations and locations, which I will discuss in detail in this guide. However, it is important to mention that this is a one-time opening in a year, and if you miss the date somehow, you will have to wait till next year, unless you qualify for a Special Enrollment Period (SEP). Let's know about the important bits of the OEP, and help you feel confident about your choices.

The Open Enrollment Period is your annual official time set by the Government to enroll or sign up for the ACA health insurance. In other words, from November 1 to January 15, about 2.5 months, you can buy and change your health insurance and be eligible to get coverage through the ACA Marketplace (Obamacare).

The Time Period for signing up or Enrollment has been divided into two parts. The time span is Nov–Jan for signing up, but your coverage may start either Jan 1 or Feb 1, depending on when you enroll.

November 1is the first day of the enrollment period, and it lasts until January 15. Any day within this range, you can apply for your health insurance plan for the upcoming year. But early birds will get early coverage.

Example:

Visual Element: https://claude.ai/public/artifacts/ff24317d-672e-4eea-8777-bc3ca026a459

Quick note:

Some states that run their own marketplaces might have slightly different or extended deadlines. Always check your state's specific dates!

If you get health insurance through your job, the enrollment dates are decided by your employer, not by the government, and can vary.

2025 Example (California employers)

Special Enrollment Period (SEP) lets you sign up for health insurance when you miss the Open Enrollment Period for any valid reason. An SEP is triggered by a "qualifying life event," which generally means a significant or sudden incident takes place in your life for which you cannot sign up at the official time. And, these events or incidents usually give you a 60-day window to make changes.

It’s important to know that if you qualify for an SEP, you’ll likely need to provide documents to support your claim, and the specific requirements might vary depending on the event. So, keep those important papers handy!

Before the Open Enrollment Period, you need to get prepared properly. Here’s a smart, easy checklist to get ready to navigate your options for Open Enrollment.

Think about how much you paid out-of-pocket last year for your coverage, like therapy, prescriptions. Consider upcoming needs like surgery, having a baby, or more specialist visits to choose a plan that actually fits.

The Open Enrollment Period is the perfect time to reevaluate your current health plan. Think about whether it is blocking access to the doctors you need. Are co-pays rising? If it's a financial or care burden, now’s the time to switch.

You must compare premiums, deductibles, co-pays, and in-network providers in different plans. ACA Marketplace allows side-by-side comparisons, including metal tiers (Bronze, Silver, Gold, Platinum) and even your prescriptions/providers for accurate cost estimates.

Your income is one of the most important factors to determine your subsidies, so accurate income projections are crucial to choosing the right health plan according to your needs.

Keep up to date with the latest ACA premiums are rising (e.g., 4% for Silver, 5% for Bronze)

It happens. If you find that Open Enrollment has passed you by, don't panic. You still have options:

Navigating health insurance can feel overwhelming, but you absolutely don't have to do it alone! There are real people ready to offer guidance:

An important thing for getting the best health coverage is to be aware of the ACA Marketplace, as it changes, and many updates are included from time to time.

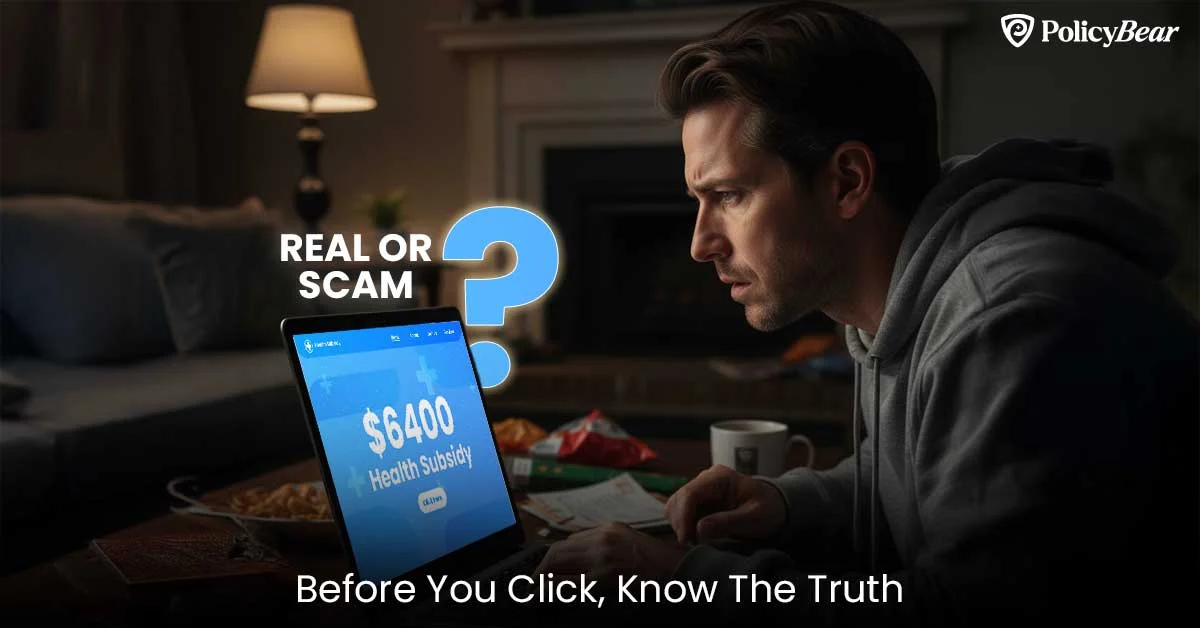

Open Enrollment is just a date; the more critical part is to understand your options, compare plans, and prepare can empower you to make choices that truly support your well-being and financial peace of mind. Therefore, you have to go for authentic information.

You can find agencies like Policy Bear, navigators, Certified Application Counselors (CACs), State Marketplace Call Centers, and In-Person Help near your Marketplace. They are trained professionals who provide free, unbiased help. Most states offer phone lines and walk-in centers where you can get real-time support from trained representatives during Open Enrollment. So what is stopping you from being confident?

References:

Nov. 25, 2025

Nov. 12, 2025

Nov. 12, 2025

Nov. 1, 2025

Nov. 1, 2025

Oct. 6, 2025

Sept. 25, 2025